Friday, April 9, 2021

Always higher, always farther away

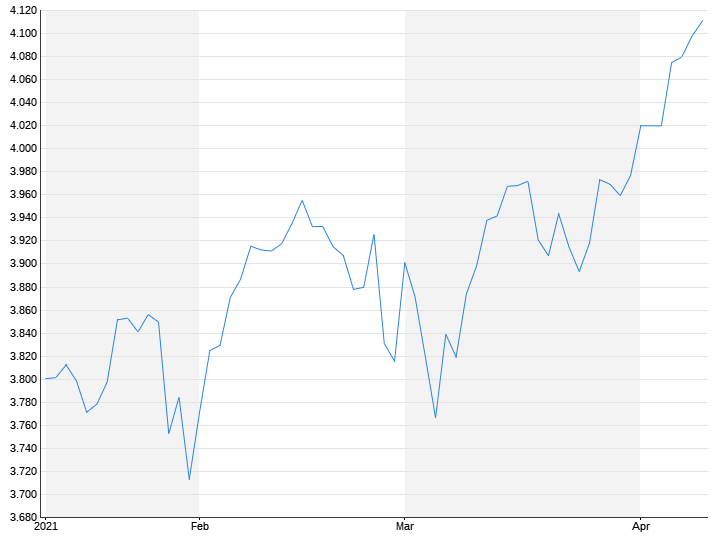

The Dow and Standard & Poor’s 500 Index set a new record

Financial markets still know only one direction. At the end of the week, the Dow Jones and S&P 500 indices rose to all-time highs despite rising numbers of coronavirus cases worldwide. However, this is exactly where the price of oil is suffering.

US stock markets rose again at the end of the week. Shortly before the closing bell, prices have rebounded significantly again. American Standard Values Index Dow Jones It rose 0.9 points to a record high of 33,801 points. The widest Standard & Poor’s 500 It also reached its highest level ever, an increase of 0.8 percent at 4,128 points. Heavy technology Nasdaq By 0.5 percent. Dax And Eurostox 50 Previously closed almost unchanged.

Therefore, the sudden strong increase in producer prices in the United States did not have a negative effect. The US Federal Reserve has repeatedly stated in the recent past that rate increases are likely to be temporary and that it will not take any action against them.

In a panel discussion at the International Monetary Fund (IMF), US Federal Reserve Chairman Jerome Powell also emphasized that the Fed will not change its previous monetary policy in the foreseeable future. In addition, US President Joe Biden has submitted his first draft budget to Congress, which concerns stockbrokers especially because of the planned additional trillions in economic aid.

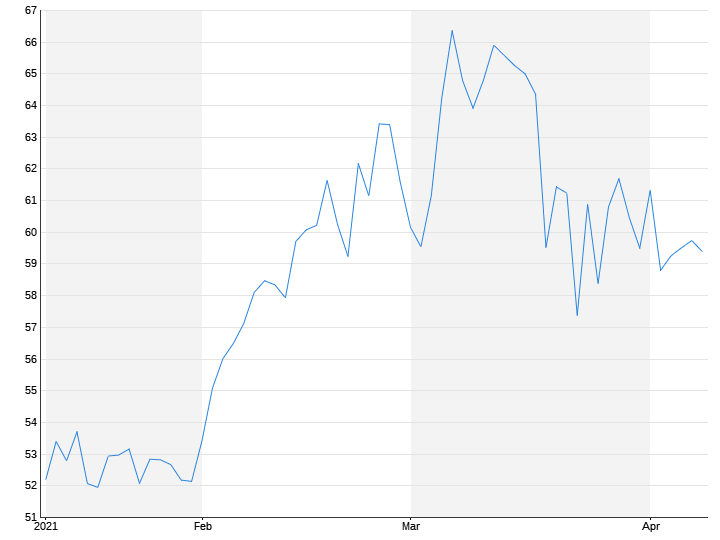

The stability of the dollar and the price of oil under pressure

US producer prices rose sharply more than expected in March. It increased by 1.0% compared to the previous month, while economists had expected an increase of only 0.4%. For the base rate as well – without the volatile food and energy prices – the increase was stronger than expected. The massive increase in gasoline prices is said to be primarily responsible for this increase.

Settled in the foreign exchange market Dollar indexThat reflects the exchange rate of the major currencies, at the end of the week at 92.2 points. On the one hand, Commerzbank analyst Antje Praefcke said the possibility of a rapid normalization of the US economy supports the world’s leading currency. On the one hand, the Fed’s announcement of a very loose long-term monetary policy is a burden.

The price of oil has decreased. US variety West Texas Intermediate It fell 0.3 percent to $ 59.40 a barrel (159 liters). According to experts, the rising number of coronavirus cases in some regions has fueled fear of a drop in demand. In addition, Iranian oil should be expected to return to the world market if nuclear talks with the Islamic Republic progress and sanctions are eased, said analyst Helima Croft of investment bank RBC Capital Markets.

Johnson & Johnson loses, Amazon wins

In terms of individual values, the share went from Johnson & Johnson (J&J), down 1.1 percent. Given the quality defects recently identified at a contract manufacturer, which has rendered about 15 million doses of J & J’s Corona vaccine unusable, the pharmaceutical company will offer 80 percent fewer vaccine doses in the United States next week than this. In addition, the European Medicines Agency (EMA) is studying the possible link between J&J vaccine and thrombotic states.

Boeing It lost 1.0 percent. Just a few months before the 737 MAX was re-registered, the aircraft manufacturer informed several airlines of a potential new problem with the aircraft’s electrical system.

Honeywell (+ 3.4%) took advantage of some positive analyst comments. Among other things, Deutsche Bank upgraded the stock to “buy”.

Amazon By 2.2 percent. The majority of company employees voted at the Bessemer Alabama site against forming a union.

Levi Strauss Gained 2.6 percent. The jeans manufacturer delivered better-than-expected quarterly numbers and was optimistic about the current second quarter.

Turquoise mining company is on the rise

In the advanced company Turquoise Hill In the spotlight. Shares of the Canadian mining company listed in the United States rose 3.0 percent after the company and its mother, Rio Tinto, agreed to finance the expansion of the “Oyu Tolgoi” mine in Mongolia. There is one of the largest known deposits of gold and copper in the world. The explosion of costs sparked a dispute between Rio Tinto and Turquoise Hill.

Addresses Lucera It gained 2.8 percent. According to the information, the Corona test conducted by the medical technology company detects at least 99.9 percent of all variants of the Coronavirus, including the “double mutant” from India. Progress in developing a drug to treat coronavirus patients has received rations from Redhill Biopharma Price increase of 8.3%. According to the information, an independent panel of experts unanimously agreed to continue testing with the agent.