Monday, May 17, 2021

Daily and Fixed Deposit Account

There is still – something – interest

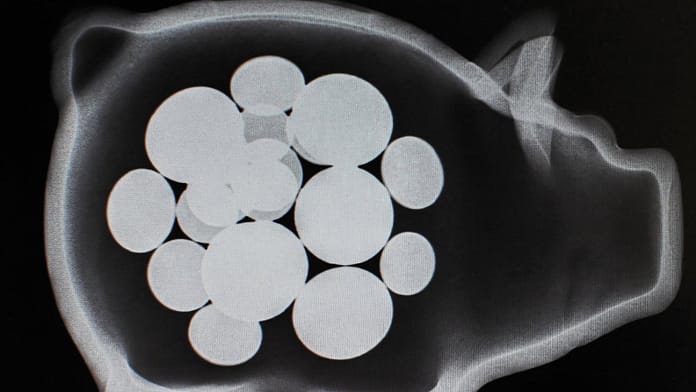

There is an ice age on the interest front. Despite significantly increasing inflation. However, German savers prefer to invest their money in savings books, daily accounts and fixed-term accounts. Finanztest knows where saving can still be beneficial, at least in theory – without any custody fees.

Not only is the interest on savings staying downstairs and inflation has increased rapidly. Even if this should only be the case temporarily. Additionally, there have also been increasing reports that more and more banks are charging penalty interest on their private clients’ deposits in overnight or fixed term accounts. This is especially bitter for many, as savers in this country especially like to store their money in the aforementioned accounts.

Financial test I wanted to know in its current issue (Issue 6/2021) where something is still to be acquired and, above all, where the so-called nursery fees can be avoided. According to the testers, customers should not simply accept negative interest rates, but can switch banks. Because there are still providers who pay interest. The fact that inflation is also eroding, and thus, as is often the case, a negative real interest rate is another matter. But Finanztest at least lists super-regional offers for an example amount of 5,000 euros in our list of the top 20 overnight money accounts. Bank11, Leaseplan Bank, Sberbank Direct, TF Bank, Klarna Bank and Advanzia Bank all offer interest and return of 0.2 percent per annum. Basically, two to three months’ salaries should be available in the overnight funds account for financial emergencies.

So check who has been connecting forever

Investing in fixed term deposits can be beneficial for larger amounts. Unlike overnight funds, the fixed term deposit interest rate is fixed throughout the term. This calms you down, but it can also have negative effects when interest rates go up. For a long time it should Money can be invested firmly only if the saver is absolutely sure that the money will not be needed during the term. Early exit from most products is impossible or difficult to do, and this is associated with heavy costs or loss of interest.

According to Stiftung Warentest, Dutch bank Leaseplan provided the highest return to banks tested at the time of investigation: for one year, fixed-term deposit of at least € 1,000 at 0.55 per cent, two years with 0.65 per cent and three years at 0.75 per cent interest.

Finanztest generally recommends offers from banks in the European Union countries as well as from the European Economic Area (EEA) countries, which consistently receive the highest marks for their economic strength. Here funds are protected up to € 100,000 per bank and are routed according to the corresponding European Union directive.