Oil prices are strengthening today on the back of positive figures from the Chinese and US economies. They wiped out part of the losses from the previous session, and Brent and WTI oil were discounted more than three dollars due to the increase in production of the OPEC + Group and the effects of the Kovidu-19 epidemic. This causes constant market fluctuations.

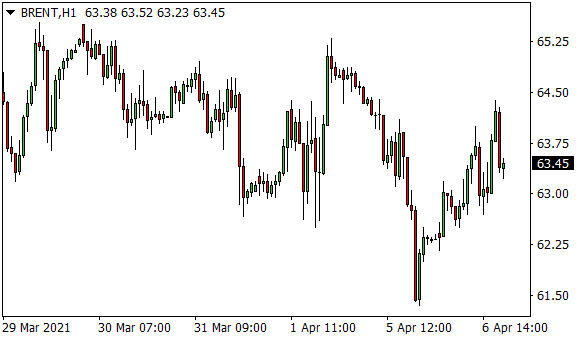

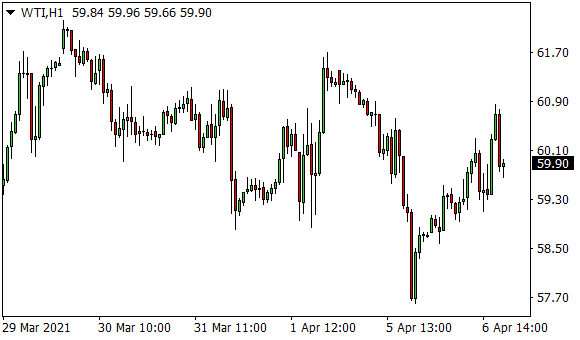

At 18:15 CEST, North Sea oil Brent rose 1.8 percent to $ 63.28. US light crude WTI rose 2.1 percent to $ 59.86.

The Supply Management Agency (ISM) on Tuesday announced a record high in the U.S. Services Services Index for March. The service sector also strengthened in China, where sales saw a sharp increase in three months.

From Monday, it will release anti-epidemic measures from the UK, which will open, among other things, not only essentials, but also outlets of restaurants or open shops selling hairdressers. However, oil prices have been adversely affected by the new regulations in most parts of Europe and the rise of new epidemics in India.

The OPEC + Group, which brings together key producers of the Organization of the Petroleum Exporting Countries (OPEC) and their allies, including Russia, decided on Thursday to increase production every month from May to July: 350,000 barrels in May, and another 400,000 barrels a day in June and July at 350,000. Iran has begun deregulation of production, and oil production is on the rise.

Brent oil price improvement (1-hour chart – H1):

WTI Oil Price Improvement (1-Hour Chart – H1):

Source: CDK, Reuters, MD4

read more

-

Materials: Oil rises more than a dollar in response to declining U.S. inventories

A barrel of oil is about a dollar more expensive today. The fall in US oil reserves has allayed fears of lower demand as a result of the US-China trade war. Around 18:00 a.m., Brent North Sea crude rose 2.08 percent to $ 60.75 a barrel. US light crude WTI rose 2.6 percent to $ 56.36. -

Commodities: Oil prices rise, supporting the redemption of stocks

Oil prices are rising today, supporting a recovery in the stock market. However, the raw materials on the market are about to be oversupply. At 7:30 pm, Brent North Sea crude was up 0.2 percent at $ 52.25. Meanwhile, the West Texas Intermediate (WTI) U.S. light oil rose 1.4 percent to $ 45.25 per barrel. -

Commodities: Oil US reserves rise in price after a surprising drop

The U.S. announced on Wednesday. Oil prices are rising today in response to the surprising fall in inventory, and following the Organization of the Petroleum Exporting Countries’ (OPEC) comments on lower shale oil production in the United States than expected in 2020. -

Commodities: Oil US oil stocks rise unexpectedly following a report

Oil is becoming more expensive today. This raw material contributed to the unexpected decline in US stocks. In the market sense, this information outweighs the lingering concerns about the negative impact of the COD-19 epidemic on oil demand. -

Materials: Oil becomes more expensive before OPEC decides to further reduce production

Oil prices continue to rise today. Representatives of the Organization of the Petroleum Exporting Countries (OPEC) are in talks to extend last year’s agreement to reduce oil supplies to markets in Vienna. Representatives from the mining states outside the cartel will join them on Friday. -

Materials: Oil is getting more expensive. The publication of isolated activities contributes to this

Oil is becoming more expensive. The release of isolated activities and the reduction of market segregation are greater than the devastation caused by the origin of the corona virus in the United States and China. -

Materials: Oil rises, growth supported by stimulus measures in the United States

Oil prices are rising today, mainly in the United States, driven by expectations that new stimulus measures will increase fuel demand. North Sea Brent crude was up about one percent at $ 51.35 a barrel at 5:35 PM CET. U.S. West Texas Intermediate (WTI) light oil then rose 1.1 percent to $ 48.15. -

Materials: Oil prices rise, North Sea Brent to less than $ 64 a barrel

Oil prices are rising slightly today. Again, they were encouraged by reports of the progress of US-China trade talks, which also helped them in a survey last week that estimated US oil inventories had fallen. -

Commodities: Oil is getting more expensive. The market expects large producers to reduce production

Today, oil prices are rising and approaching a three-month high. The market expects large oil producers to extend production cuts by agreeing in a video conference this week. -

Materials: Oil becomes more expensive, but higher growth is hampered by a weak demand perspective

Oil prices are rising today as supply disruptions in the United States raise concerns about Hurricane Sally. However, high growth is a major obstacle to the expected infection recovery outlook rather than a weak one. -

Commodities: Oil is becoming more expensive, influencing the progress of negotiations between the United States and China

Today, oil prices are approaching a three-month high. They say the United States and China have reached the first stage of a trade deal and are adhering to the report on Friday. -

Commodities: Oil becomes more expensive in the hope that it can reduce its supply to the OPEC + market

After a two-week decline, oil is rising again today. This is helped by the hope that the Organization of the Petroleum Exporting Countries (OPEC) and its allies will deepen existing mining cuts. Concerns about the declining demand for corona virus infection have also obscured such a hypothesis. Concerns about the possible effects of the corona virus sent oil to its lowest level on Monday for more than a year. -

Ingredients: Oil becomes more expensive, which can add up to more than six percent a week

Oil prices are up 11 months today and could add more than six percent a week. This is mainly due to Saudi Arabia’s commitment to control mining and it has benefited the growth of global stock markets, which has stopped further growth for corona patients. -

Commodities: Rising US stock prices due to oil fall

World oil prices are falling sharply today, bringing North Sea Brent oil to less than $ 60 a barrel for the first time since January. There is a report of a surprising increase in raw material stocks in the United States in the wake of the fall in prices. -

Materials: Oil is down more than a dollar

World oil prices fell by more than a dollar today following orders by Russian President Vladimir Putin. -

Materials: Oil is getting cheaper, partly due to Russia’s situation

The week started with the fall in oil prices. In part, this was a reaction to a message from Russia, which, according to traders, signaled over the weekend that it would maintain a high level of raw material extraction. However, upcoming U.S. sanctions on Iranian oil exports are preventing a sharp fall in prices. -

Materials: Oil is getting cheaper, but close to a three-month high

Oil prices are down slightly today, but are nearing a three-month high. They are being pushed down by Russia’s report that the Organization of the Petroleum Exporting Countries (OPEC) and its allies may consider easing agreed agreements on oil production in March. However, the market is still optimistic about the signing of the US-China trade agreement. -

Commodities: Oil is getting cheaper, investors are wary of the Sino-US deal

Oil prices are down nearly three percent at the start of the new week, with investors waiting for details of the US-China trade deal to be released. The first part of it was announced on Friday by US President Donald Trump. -

Commodities: Oil is getting cheaper, and investors are reassessing the risks in the Middle East

Oil prices were handed over today on part of profits from previous days. Reuters reports that investors are reconsidering fears of a sudden disruption to oil supplies from the Middle East following the US assassination of Iranian General Qasem Solezmani. -

Materials: Oil becomes cheaper due to Arab projects to increase production

Plans by Saudi Arabia and the United Arab Emirates to increase production capacity due to oil prices are falling today. In addition, the negative economic impact of the new type of corona virus is worsening the outlook for oil demand.